Understanding Medicaid & Trust Eligibility in Washington

Learn about Medicaid and trust eligibility in Washington State to help secure your future. Our easy-to-understand guide makes navigating these complex topics a breeze for seniors. We will discuss how to qualify for Medicaid, how income and assets affect eligibility, the differences between a trust and a will, and much more. With this knowledge in hand, you can ensure your wishes are followed and that your retirement years are secure and comfortable.

Additionally, we will provide information about resources such as community-based organizations and government programs to help you access additional services and secure the safety net you need. Whether you’re just starting to think about planning for your future or are already an expert, this guide will provide you with the information you need to make sound decisions in Washington State.

An Intro to Using Medicaid for Trust Planning

As you approach your golden years, understanding your financial options is crucial for securing your future. For many seniors, Medicaid and trust eligibility are essential components of long-term care and estate planning. This simple guide will explore how Medicaid and trust eligibility work in Washington State. We hope these easy-to-follow explanations will empower you to make well-informed decisions about your healthcare and financial future.

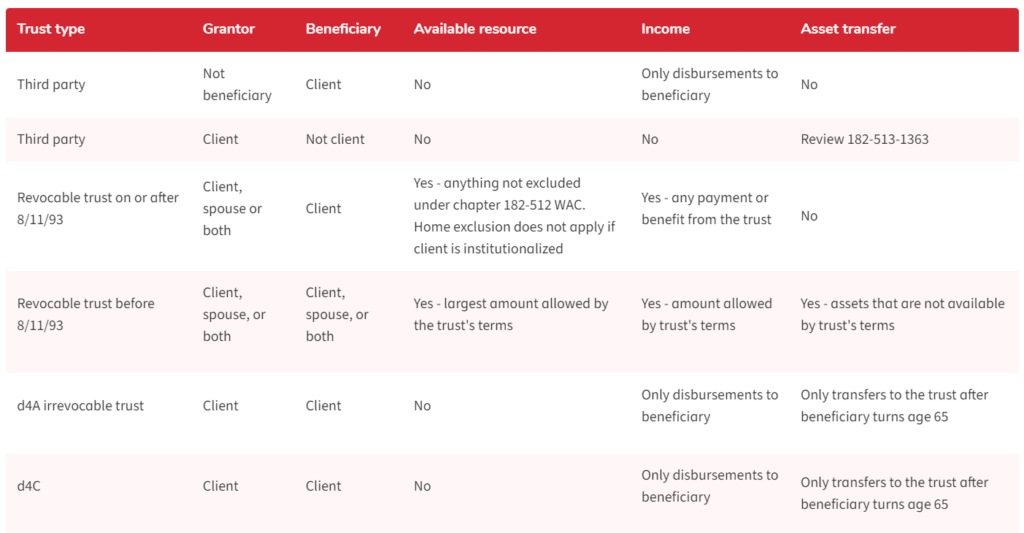

As you can see from the following image from the Washington HCA website, navigating the complex maze of Medicaid Eligibility in Washington State may not be as straightforward as you’d hoped. Many conditions exist to ensure those who should be paying for their own needs do, and these rules can surprise folks. In this guide, we’ll explain what qualifies you for Medicaid and Trust Eligibility, how to estimate your financial needs, and how taxes can play a role in beneficiary distributions.

Medicaid in Washington State

Washington State’s Medicaid program, known as Washington Apple Health, provides healthcare coverage to eligible low-income residents, including seniors. Medicaid can help cover long-term care costs like nursing homes or in-home care services. However, understanding the eligibility criteria for Medicaid is vital to ensure you receive the support you need.

Income and Asset Limits

You must meet specific income and asset requirements to qualify for Medicaid in Washington State. The income limit for seniors 65 and older is 100% of the Federal Poverty Level (FPL). The asset limit is $2,000 for an individual applicant and $3,000 for a couple applying together.

Exempt Assets

Certain assets are exempt from the asset limit calculation, meaning they won’t affect your Medicaid eligibility.

These include:

- Your primary residence

- One vehicle

- Personal belongings

- Household items

- Burial plots

- A small amount of life insurance

The Five-Year Look-Back Period

When you apply for Medicaid, the state will look back at your financial transactions from the past five years to ensure you haven’t transferred assets to qualify for the program. If you have made such transfers, you may face a penalty period during which you will be ineligible for Medicaid coverage. The five-year look-back period is a critical aspect of determining Medicaid eligibility, as it aims to prevent applicants from transferring assets to qualify for the program artificially. In this section, we will explain the five-year look-back period in Washington State in more detail.

Suppose the Health Care Authority finds that you have transferred assets for less than the fair market value during the five-year look-back period. In that case, you may be subject to a penalty period. The penalty period is a length of time during which you will not receive Medicaid benefits, even if you meet all other eligibility criteria. The length of the penalty period is determined by dividing the total value of the transferred assets by the average monthly cost of nursing home care in Washington State.

Trusts and Medicaid Eligibility

A trust is a legal arrangement that allows a third party (the trustee) to hold and manage assets on behalf of the trust’s beneficiaries. Trusts can play a crucial role in protecting your assets and ensuring Medicaid eligibility.

Irrevocable Trusts

When structured correctly, an irrevocable trust can help you qualify for Medicaid while preserving your assets for your beneficiaries. An irrevocable trust cannot be modified or revoked after its creation, meaning that the assets in the trust are no longer considered part of your estate. However, working with an experienced attorney is essential to ensure your trust complies with Washington State’s Medicaid rules.

Revocable Trusts

A revocable trust, also known as a living trust, can be altered or revoked during your lifetime. While revocable trusts are helpful for estate planning purposes, they typically do not protect your assets from being counted towards the Medicaid asset limit.

Special Needs Trusts

If you have a disabled child or other family members who rely on government benefits. In that case, a special needs trust can ensure they maintain eligibility for these benefits while still receiving financial support from your estate.

Estate Recovery

Washington State’s Medicaid Estate Recovery Program seeks reimbursement for the cost of long-term care services provided by the program. Upon your death, the state may attempt to recover these costs from your estate.

Protecting Your Home

One of the primary concerns for Medicaid recipients is the potential loss of their home to estate recovery. However, several exemptions and strategies can help protect your home from estate recovery:

- Surviving Spouse or Registered Domestic Partner: If you have a surviving spouse or registered domestic partner, the state will not pursue estate recovery until their death.

- Minor or Disabled Child: Estate recovery is also postponed if you have a minor or disabled child living in the home.

- Caretaker Relative: If a relative has lived in your home for at least two years and provided care that prevented your admission to a nursing home, they may be eligible for an exemption.

- Hardship Waiver: Your heirs can apply for a hardship waiver, which may exempt your property from estate recovery if they can prove that the property loss would cause undue hardship.

Life Estate Deed

Another strategy to protect your home is to create a life estate deed. A life estate deed allows you to retain the right to live in your home for the rest of your life while transferring ownership to a designated beneficiary. This can help avoid probate and reduce the risk of estate recovery. However, it’s crucial to consult with an experienced attorney before pursuing this option, as it may have implications for Medicaid eligibility during the five-year look-back period.

Understanding Medicaid and trust eligibility in Washington State is crucial for seniors looking to secure their future and protect their assets. By familiarizing yourself with income and asset limits, the different types of trusts, and estate recovery rules, you’ll be better prepared to navigate the complex world of long-term care and estate planning. Working with an experienced elder law attorney can ensure you make the best decisions for your unique situation.

Don’t leave your future to chance. Contact our experienced estate planning attorneys today at 509-328-2150 to discuss your Medicaid and trust eligibility options in Washington State!