Millennial Mindset: 2023 Millennials Estate Planning Survey

The recent “2023 Millennials Estate Planning Study” by Trust & Will provides valuable insights into the younger generation’s attitudes and anticipations toward wealth accumulation, inheritance, and legacy. In this article, we delve into the key findings of this groundbreaking study and their implications for estate planning and wealth transfer in our modern digital age.

1. Multigenerational Wealth as a Millennial Priority

Building Bridges, Not Walls: Millennials and the Importance of Multigenerational Wealth

In a revealing divergence from older generations, 78% of Millennials reported that building multigenerational wealth is crucial to them. This starkly contrasts the sentiments of their predecessors, where 45% deemed it unimportant. This growing trend amongst Millennials could result from socio-economic shifts, where they are more cognizant of the importance of financial security for future generations. Understanding this priority for Millennials is paramount in planning estates that aim to foster long-term wealth, ensuring that their estate planning needs are efficiently met.

2. Millennials Estate Planning Expectations & Dependence on Inheritance

The Inheritance Expectation: A Closer Look at Millennials Estate Planning

Over half of the Millennials surveyed expect to receive an inheritance within their lifetime, highlighting a significant generational expectation. However, interestingly, only 11.5% rely on this expected windfall as part of their financial planning. This demonstrates the dynamic financial consciousness of Millennials, reflecting a careful balance between hopefulness and pragmatism in their approach to future finances and estate planning.

3. Impact of the Housing Crisis on Millennial Wealth

Weaving through Walls: Millennials, Wealth, and the Housing Crisis

A substantial 45% of Millennials acknowledge the impact of the current housing crisis on their ability to pass on wealth. This recognition indicates this generation’s economic challenges, thus influencing their decisions around wealth accumulation and transfer. Consequently, these insights are crucial in formulating responsive and tailored estate planning strategies that account for these current housing market difficulties.

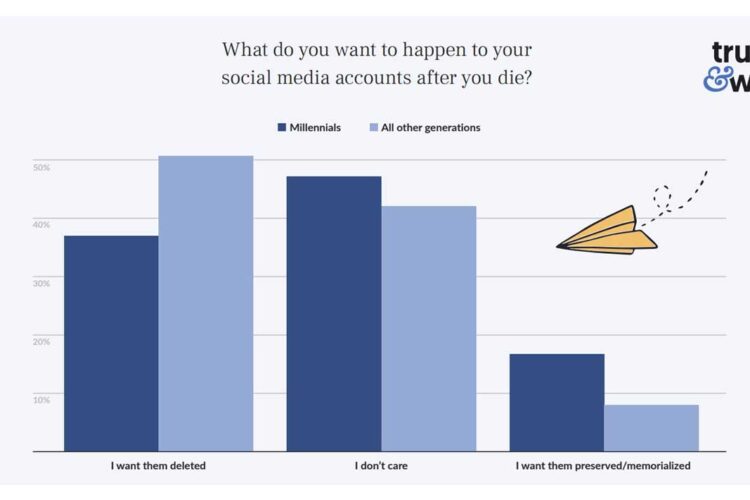

4. Rise of the Digital Executor in Millennials Estate Planning

Stepping into the Digital Age: The Emergence of the Digital Executor

As digital natives, it is no surprise that 74% of Millennials have designated a digital executor in their estate plans to manage their online affairs and social media accounts. This reflects the growing digitalization of our lives and the emerging importance of digital legacy management. Therefore, modern estate planning services must adapt to these needs, ensuring comprehensive millennials estate planning that includes tangible and digital assets.

5. Privacy Paradox: Millennials & Digital Communications

Privacy Matters: Millennials’ Preference for Keeping Digital Communications Confidential

Millennials are 29% more likely than older generations to prefer keeping their emails, direct messages, and texts private from their family. This finding highlights this generation’s premium on digital privacy, even posthumously. As such, it underlines the need for millennials estate planning services to incorporate privacy-preserving strategies into their digital legacy management, respecting the client’s posthumous privacy wishes.

6. Charitable Giving from Millennials w/ Low Net Worth

Embracing Philanthropy: The Charitable Dispositions of Millennials

In an intriguing insight, 67% of Millennials with net worth of $50,000 or less have chosen to leave money to charity. This underlines the generation’s propensity towards altruism and social responsibility, regardless of their wealth. Estate planners should, therefore, consider such philanthropic inclinations while formulating plans, ensuring that the wills and trusts they establish for Millennials reflect their desire to contribute to a larger cause.

The “ 2023 Millennial Estate Planning Study ” sheds light on the unique perspectives of the millennial generation regarding wealth, inheritance, and legacy. Their recognition of multigenerational wealth, the impact of the housing crisis on wealth transfer, the anticipation of inheritance, the adoption of digital executors, the priority for privacy, and even their penchant for charity despite personal wealth all highlight a generational shift in perceptions of wealth and legacy.

Estate planning professionals, therefore, need to understand and adapt to these changes, creating strategies that align with these millennial inclinations. As far as the landscape goes when estate planning for millennials – we at Moulton Law Offices do our best to accommodate these trends and are committed to navigating these complexities, so we can help our clients build a legacy that reflects their values, priorities, and aspirations.

If you’re a millennial starting to research your wealth planning journey and would like more information on topics such as power of attorney – use our contact page or consider attending a webinar .

Trust & Will also provides a look into estate planning trends 2022 .